Habo’s strategic perspective

Are online events a monetization strategy for the entertainment industry?

May 6, 2020

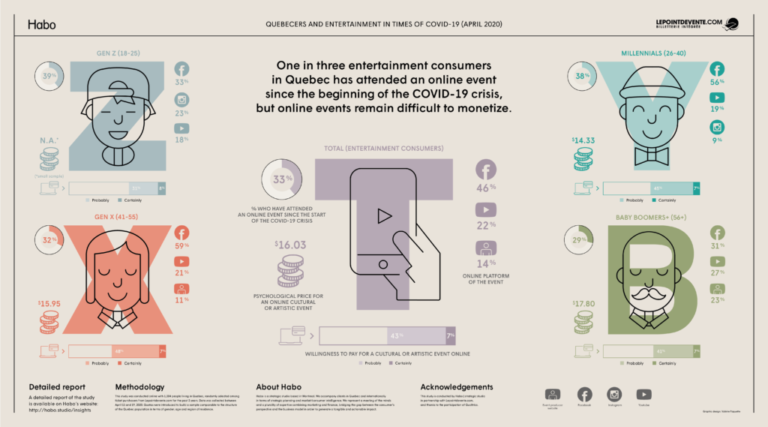

During the first month of COVID-19 confinement, one third of entertainment consumers in Quebec had consumed an online event. We could have expected online event consumption to be higher amongst younger people, but it turns out to be relatively uniform across all age groups (39% for Gen Z compared with 29% for Baby boomers, for instance).

Although the appeal of online events is strong, the content is difficult to monetize. Even though 50% of responders say they are certainly or probably willing to pay for online content, spending intention reported through market research is generally overestimated. If we focus specifically on those who are “certainly” willing to pay for an online event, the monetization potential is between 7% and 8% of online event consumers.

(download)

This is a typical chicken-and-egg situation: are few consumers willing to pay for online events because the supply is low, or is the supply low because consumers are reluctant to pay for this content?

It is difficult to monetize content due to the large quantity of free content available.

Free artistic and cultural content abounds. The Metropolitan Opera offers free streams of their most popular operas on their website. One of Pink Floyd’s legendary concerts is available for streaming every Friday on YouTube. Cirque du Soleil presents 60 minutes of its shows each week. On a smaller scale, musicians, singers and comedians maximize the use of social platforms to strengthen their relationship with their fans.

This abundance of online content has an impact on its perceived value. We are at a crossroads: it will be hard to get consumers to pay for something they are used to getting for free.

The reason for this abundance is simple: artists and brands are positioning themselves in an audience engagement perspective, rather than focusing on monetizing their content. If the Metropolitan Opera or the Cirque du Soleil broadcast their content for free, their purpose is not to monetize it but to retain their brand awareness with consumers. While this strategy is adapted to the context of the short-term situation, its relevance in the medium to long-term is questionable.

The business strategy for online events needs a rethink.

For content to be monetizable, it must be based on:

- a strong value proposition anchored in a clearly defined consumer need (example: further to the success of AirBnb experiences, a few days ago the company launched a virtual alternative rooted in its values of human connections and adventure);

- a strong differentiation strategy (example: the success of the Masterclass platform content, whose differentiation strategy builds on prestigious instructors as well as polished aesthetics – and justifies a high access fee of $90 per class)

- a perception of scarcity so the perceived value justifies the price (example: boxing events for which consumers are used to the Pay-Per-View model).

However, content monetization strategies can (or must) also (or mostly) be indirect.

Content producers question how much consumers value online content and, consequently, what they would be willing to pay for virtual consumption. Yet, even with an adequate business model, direct content monetization is not a given for most artists and brands.

In the short term, there are certainly opportunities to introduce monetization around a message of support for the artistic or cultural community (in the form of donations or voluntary contributions). But this message has a limited lifespan.

Over the medium to long term, the business model for online content should be part of an overall business strategy:

- The streaming of online events can be based on an advertising strategy (monetized through the broadcast of advertisements) or on sponsorship (financed by a partnership with a brand).

- Online content can be part of a freemium/premium strategy, whereby part of the content is available for free and serves as a hook to convert a portion of the consumers into buyers.

- The content can be considered as an acquisition strategy for artists, organizations or brands, with a lower acquisition cost for new customers/fans than classic marketing initiatives (advertising, direct marketing, etc.). This way, monetization takes place at the level of customer lifetime value.

- Online events can also be used to build brand equity for an artist or a company. We can therefore expect a positive long-term return (although more difficult to quantify) rather than direct and immediate monetization.

The opportunity is just as great as the strategic challenge it poses.

In the past few weeks, two Quebec players launched an online event streaming solution: Lepointdevente.com and Yoop. A study by Grand View Research published in February 2020 projects an average annual growth rate of 20.4% for the live-streaming market. The consumer’s appetite is there but substantial efforts will have to be made to create the habit of paying for an online event.

Over the next weeks, thanks to the Entertainment barometer launched on April 29, 2020, we will be monitoring the evolution of online artistic events consumption as well as the willingness to pay and the average psychological price.

Want to know more?

- The infographics above is downloadable via the link at the bottom of this article.

- A detailed report of the “Entertainment barometer” study is available here.

- For any additional information, you can contact us here.

Methodology

This study was conducted online with 1,004 people living in Quebec, randomly selected among ticket purchasers from Lepointdevente.com for the past 3 years. Data was collected between April 11 and 19, 2020. Quotas were introduced to build a sample comparable to the structure of the Quebec population in terms of gender, age and region of residence.

Acknowledgements

This study is done in partnership with Lepointdevente.com, and thanks to the participation of Qualtrics.

Graphic design by Valérie Paquette.

Download this document

Download this document